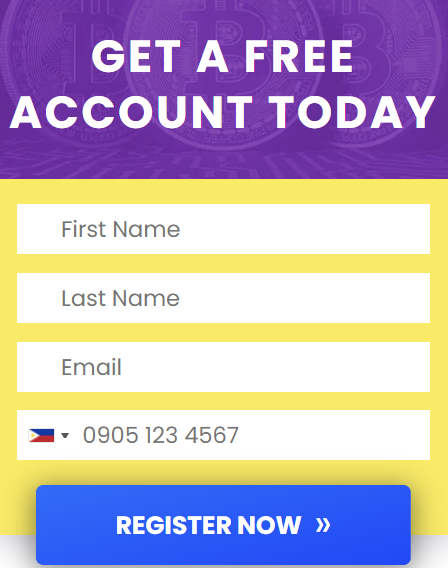

Cryptocurrency has gained immense popularity as a trending topic and also as a very financial instrument of high profit for investors. People all over the world use it as a nature of digital currency that is protected by encryption. Click this image below to start your bitcoin journey.

Additionally, a cryptocurrency has a different name depending on which company is in charge of making them. Further, digital assets have become popular with investors because the crypto markets are open 24 hours a day to anyone who wants to buy or sell these things. It’s important to know that cryptocurrency prices can change very quickly. It is still possible to navigate the market and control risk, even though the market is very volatile and changes quickly.

Be a Wise Crypto Trader, Follow These Tips

When you invest, you should try to make the most money possible while minimizing your losses and taking care of your risks.

There are risks and pitfalls to trading cryptos, just like there are risks and pitfalls to trading stocks and commodities. People who want to make money from crypto trading need to come up with strategies that make trading both fun and secure at the same time. This article and its information will help you make money.

Build a balanced portfolio

Cryptocurrency trading is still in its development stage. Even though some countries allow people to trade in the cryptos, others still don’t believe that it’s safe to do so. A lot of work is being done by central banks around the world to better regulate digital currencies, which means that trading in cryptos can be risky. However, you can apply various ways to avoid extreme volatility.

Bitcoin, Dogecoin, and Ethereum are all good currencies to have in a well-balanced portfolio to keep your money safe.

Also, investors can set a certain amount of money to invest in different types of cryptos every month. This will ensure you and you will be more willing to take risks systematically. As a result, your portfolio will be more profitable in the long run.

Primary research

The best way to successfully trade is to do your research. However, you do not need to be a trading expert to undertake primary research on the worth of an asset you desire to acquire. This entails staying current on all cryptocurrency-related news.

Additionally, you need to think about your funds and set a goal for your investments before betting on a risky asset class like crypto, which can go up and down very quickly.

Do Not Gamble, Trade

The unpredictability of the outcome is a feature that both trade and gambling share. Each time someone plays, they put money down and wait to see what happens next. When it comes to risk management, though, traders aren’t like a person who likes to bet on things. To put it another way, if you buy digital currencies without taking into account the risk, you’re gambling.

It is much more uncertain with cryptos because they are an example of how volatile they are than with any other kind of security. Hence, having a strong risk management plan is even more crucial for crypto traders. It appears prudent for a trader to utilize stop-loss orders and risk just the amount that the trader is comfortable losing on the deal.

Arbitrage

Arbitrage is a term that refers to a trading method of purchasing cryptocurrency in one market and selling in another. When the purchase and sell prices are different, this is called “spread”. Traders might profit from the differential between liquidity and trading volume.

However, to take advantage of this situation, you must create an account on exchanges that have a significant spread in their crypto trading prices.

Long term vision

People who want to invest in crypto should think of it as a long-term thing. Since the market is very volatile and not very mature. New things are being tried all the time in the crypto market. In other words, it is still very new and not very predictable yet. When the market is doing well, it could have a fluctuating effect

Conclusion

Further, these tips can help crypto traders avoid some mistakes and speed up their learning curve. However, you should not substitute them for having lots of experience. People who want to become good at crypto trading should study as much as they can while they’re making money.